You may be looking for a way to make a big difference to help further our mission. If you are 70½ or older you may also be interested in a way to lower the income and taxes from your IRA withdrawals. An IRA charitable rollover is a way you can help continue our work and benefit this year.

If you have any questions about an IRA charitable rollover gift, please contact us. We would be happy to assist you and answer any questions you might have.

Benefits of an IRA charitable rollover

- Avoid taxes on transfers of up to $100,000 from your IRA to our organization

- Satisfy your required minimum distribution (RMD) for the year

- Reduce your taxable income, even if you do not itemize deductions

- Make a gift that is not subject to the 50% deduction limits on charitable gifts

- Help further the work and mission of our organization

How IRA charitable rollover gifts work

- Contact your IRA plan administrator to make a gift from your IRA to us.

- Your IRA funds will be directly transferred to our organization to help continue our important work.

- Please note that IRA charitable rollover gifts do not qualify for a charitable deduction.

Please contact us if you wish for your gift to be used for a specific purpose.

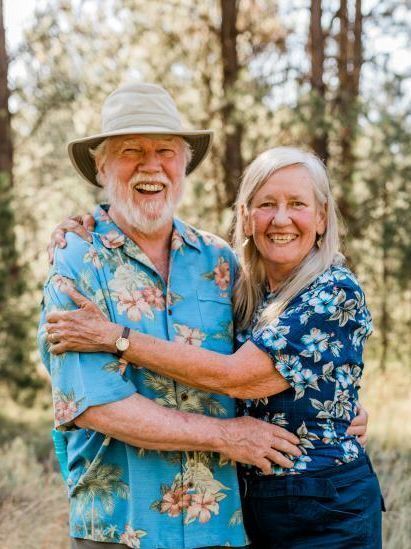

Meet Pat And Sharon

We love gardens. They are a place of wonder and discovery that provide healthy food, good exercise, and wonderful learning experiences outside. And when we run into a problem we can’t figure out, we love that the Missoula County Department of Ecology & Extension Plant Clinic can get our questions answered.

We are both Master Gardeners and were thrilled to see the new Rocky Mountain Gardens & Exploration Center come to life at the Fairgrounds. A place to slow down, enjoy nature, and perhaps cultivate a new passion for learning more. We see the garden and exploration center as an inspiration to others to promote healthy lifestyles and care for our environment. We want to help this vision thrive and discovered that we could provide a contribution through our Required Minimum Distribution (RMD) from our Individual Retirement Accounts (IRA’s). By having our financial advisor issue the check directly, we were able to support the Rocky Mountain Gardens and get a tax advantage. It is so easy to do.

If you find yourself like us and have an IRA, consider visiting with your financial advisor about this easy way to support worthy non-profits such as the Healthy Acres Healthy Communities Foundation that cultivates vibrant, thriving communities and lands.

Pat and Sharon Sweeney

Montana Endowment Tax Credit

The Montana Endowment Tax Credit (METC) is a unique opportunity for individuals, businesses, and organizations to support Montana communities while receiving a tax credit. Established in 1997, this credit allows a 40% tax credit on a qualifying planned gift's federal charitable deduction (up to $15,000 annually per individual, or $30,000 for couples) or a 20% tax credit for direct gifts by qualified businesses (up to $15,000 annually).

Planned gifts, such as charitable trusts, gift annuities, and certain estate gifts, provide donors with income and tax planning tools while supporting Montana’s charities, like Healthy Acres Healthy Communities Foundation. These gifts help sustain Montana’s nonprofits, ensuring ongoing support for community-focused programs.

Contact us for more information to make a qualified METC gift.

To learn more contact:

Jean Jenkins

Foundation Coordinator

jenkins@healthyacres.org

406-258-4221